|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

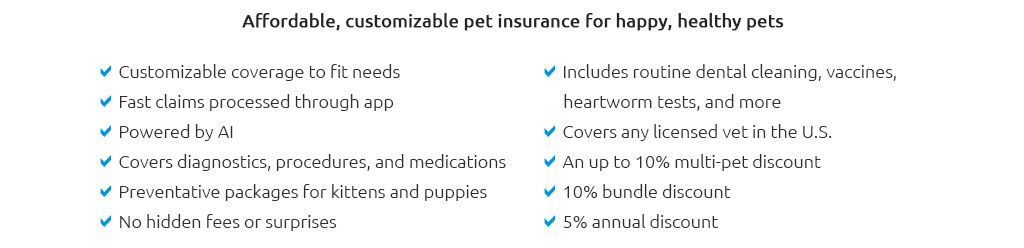

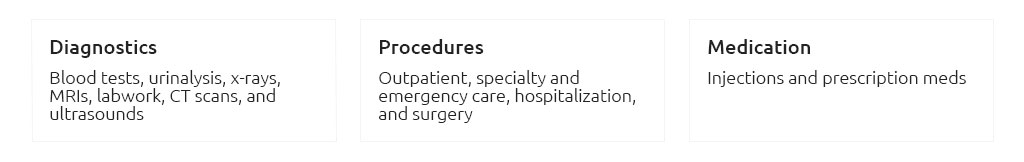

Your dog wellness insurance plan for steady, sensible careYou want predictable costs and a healthier future for your pup. That's the real point: fewer surprises, more rhythm to the year. Not perfection - just clarity that stacks up over time. What it usually covers - and what it doesn'tA dog wellness insurance plan centers on routine care: the small, repeatable things that prevent bigger issues. You might assume it's for emergencies; not quite. Emergency surgery and illnesses are different policies. Wellness focuses on the basics that keep you ahead.

Accidents, diagnostics for illness, and surgery live under accident/illness coverage. You can pair them - or not - based on your priorities. Estimating value over timeWellness can pay for itself, but the math matters more than slogans. Run your numbers calmly and you'll see the pattern.

You may think the cheapest plan wins. Close - yet if it skimps on dental or bloodwork, the "savings" can vanish the moment your senior dog needs a full panel. Deductibles, limits, and timingMost wellness setups have no deductible and use scheduled reimbursements with an annual cap. It feels like there's a monthly cap - there isn't; the schedule resets annually. Watch for waiting periods and effective dates before that first appointment.

Relevance by life stage

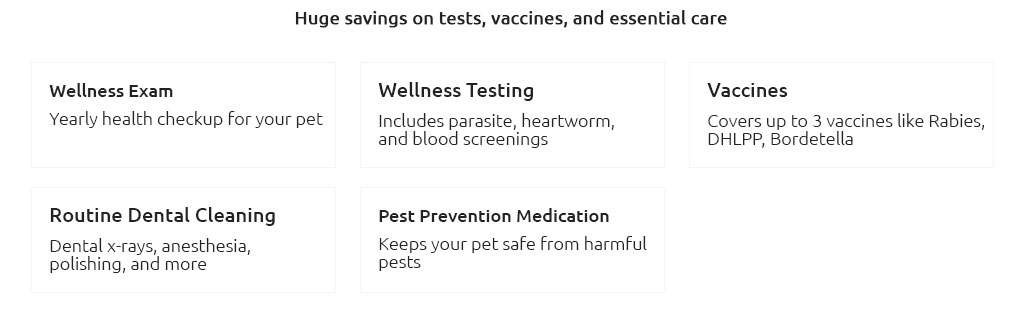

A small real-world momentApril checkup: you brought your herding mix for a wellness exam, fecal/heartworm tests, and booster vaccines. You paid at the desk, submitted the invoice on your phone in the parking lot, and a week later the plan reimbursed the scheduled amounts. Not dramatic, just tidy - and the prevention meds allowance kicked in when you picked up six months of heartworm protection. How to evaluate providers

If wellness isn't a fit right nowYou can still build a solid routine: set aside a monthly preventive fund, ask your clinic about in-house wellness packages, and use community vaccine clinics when appropriate. You can always add wellness later - though starting before your next checkup keeps the calendar clean. Decision snapshotChoose a plan if it maps to your dog's care and lowers variability across the year. It's not about saving money every single year - sometimes you simply break even. The steadiness, plus better adherence to routine care, is the quiet win. And if a plan you liked last year feels off this year, that's not a mistake; it's an update. Adjust, then carry on.

|